12/10/2025

BTC : $91,939.14

December 09th, 2025

Pye Finance Raises $5M to Unlock Solana's Idle Staked Assets With Variant and CoinbasePye Finance announced a $5 million seed funding round on December 8, 2025, led by Variant and Coinbase Ventures, with participation from Solana Labs and other investors. The company aims to revolutionize Solana’s staking ecosystem by introducing a marketplace that transforms over 414 million SOL in static stake accounts into programmable, tradeable financial assets. Founded by Erik Ashdown and Alberto Cevallos, Pye enables validators to offer more flexible staking products with granular control over rewards and lockup periods. The platform introduces a novel approach to staking by splitting stake positions into two tokens: a Principal Token (PT) redeemable 1:1 for locked SOL and a Rewards Token (RT) for staking rewards. “Validators have become the underbanked layer of Web3,” said co-founder Erik Ashdown, highlighting the company’s mission to provide sophisticated financial infrastructure for blockchain validators. The startup plans to launch a private beta in Q1 2026, targeting institutional stakers seeking more dynamic staking solutions.

October 30th, 2025

Dare Me? This Solana Project Is Paying Out Crypto for Hilarious StuntsBranded as “the most unhinged platform on the internet,” Dare Markets has raised $2 million in funding to fuel wild stunts with crypto. A man screams “What the fuck?” in a store, posts the video to social media, and smiles as he sees Solana tokens enter his wallet. This future is possible because of Dare Market—a newly launched crypto-fueled platform looking to help creators monetize viral stunts. There are two ways for dares to be funded. The first allows a user to post a dare with a bounty attached. Individuals will then post videos on social media fulfilling the dare, and the proposer chooses the winner. Otherwise, users can set their own dare that they’ll do as long as the platform can raise a specified amount of money via the “Fund-My-Dare” feature. If 69% of the dare’s funders validate that the user has done the dare, then the deposited USDC or SOL will be released. "Dare is the internet on steroids,” Isla Rose Perfito, founder and CEO of Dare Market, told Decrypt. “It offers the two things this generation wants most: money and fame. Now, anyone can post a dare or do a dare and get paid for it. For brands and creators, it’s a live laboratory for cultural moments—proof-based entertainment where the audience isn’t just watching, they’re active participants."

We're excited to announce our $5M seed round led by Paper Ventures with participation from YZi, CMT Digital, Sfermion, Halo Capital, Protagonist, 5N Canton, Eterna Capital, AMA, GSR, Selini, Presto and G20. Temple leverages Canton’s privacy-preserving architecture to deliver 24/7 markets with built-in compliance and connectivity to the broader digital-asset economy. The platform combines features of traditional electronic trading systems—such as automated order routing, all-to-all liquidity, and post-trade reporting—with blockchain innovations such as instant settlement, tokenization, and non-custodial wallets. With the new funding, Temple plans to expand its product lines to support additional assets, financial instruments, and integrations across the Canton Network.

Web3-powered AI project Perle has raised an additional $9 million in a seed round led by Framework Ventures. This brings the startup’s funding to a total of $17.5 million as it looks to build a product that “rewards users for reviewing and contributing accurate data sets to AI systems.” With the fresh injection of capital, Perle will launch Perle Labs, a product using blockchain rails and incentives for user payments and onchain attributions in an attempt to improve how AI models are trained. Perle offers "curated" data and human reviewers, according to its website. “As AI models grow more sophisticated, their success hinges on how well they handle the long tail of data inputs — those rare, ambiguous, or context-specific scenarios,” said Ahmed Rashad, CEO of Perle and former Scale AI employee. “By decentralizing this process, we can unlock global participation, reduce bias, and dramatically improve model performance.”

July 8th, 2025

Gaia Labs Raises $20M Series A to Scale Decentralized AI Infrastructure and Expand to MobileGaia Labs, creators of open-source infrastructure for decentralized AI agents and inference, today announced it has raised a total of $20 million across its seed and Series A funding.The round was led by ByteTrade/SIG Capital (Susquehanna) and Mirana/Mantle Eco Fund with participation from EVM Capital, Taisu Ventures, NGC Ventures, Selini Capital, Presto, Stake Capital, FactBlock, G20, Amber, Cogitent Ventures, Paper Ventures, Republic Crypto, Outlier Ventures, MoonPay, BitGo, SpiderCrypto, Consensys Mesh, and others. While centralized AI platforms keep their models, data, and governance behind corporate walls, Gaia infrastructure runs across an open mesh of independently operated nodes, giving developers and users full control over how intelligence is built, deployed, and monetized. "We believe AI inference should be an open resource, not controlled by a handful of corporations," said Matt Wright, CEO of Gaia Labs. "This funding lets us scale the infrastructure and ‘internet of knowledge’ that make user-owned intelligence real."

XSY.fi, a capital management platform streamlining access to advanced DeFi strategies, today announced the beta release of its flagship product, Unity ($UTY), on the Avalanche blockchain and the close of a $5 million Pre-Series A funding round. The round was led by Protagonist and Borderless Capital, with participation from Paper Ventures, Chainview Capital, Blizzard the Avalanche Fund, Sonic Boom Ventures, and other strategic investors. “DeFi has made extraordinary technical progress, but accessing complex, high-performing strategies remains fragmented and operationally intensive,” said W. Sean Ford, CEO of XSY. “Avalanche provides the speed, scalability, and composability that sophisticated DeFi strategies like Unity demand — making it a natural foundation for our platform’s debut.” Unity is a next-generation digital synthetic dollar engineered to unlock liquidity and capital efficiency within blockchain ecosystems. Constructed by pairing long spot holdings with short perpetual futures, Unity allows AVAX holders to maintain their existing AVAX exposure while accessing sustainable yield. Unity has already attracted over $20 million in commitments prior to beta release. Following the launch, XSY will kick off a limited-time points incentive program designed to reward early users and deepen ecosystem participation.

January 30th, 2024

Paper Ventures launches $25M blockchain VC fundPaper Ventures has launched a $25 million venture capital fund for blockchain startups. It’s surprising to see a new player enter the blockchain venture capital arena after a few years of turmoil among blockchain and cryptocurrency startups. But there might be some logic in coming in late to fund projects now that the hype is gone from the sector. Danish Chaudhry, Oliver Blakey and Ivailo Jordanov founded Paper Ventures and they bring extensive experience in Web3 investments and a vision to make a lasting impact on early-stage projects. The founders, with roots in Web3 investments dating back to 2010, have capped their fund at $25 million. The decision reflects their strategic focus on early-stage projects where they believe they can provide maximum value. The founding members aim not only to inject capital but also to nurture the identified projects actively. Paper Ventures pledges to leverage its founders’ broad industry experience and networks to provide portfolio projects with resources and connections for success. The $25 million fund was raised with the participation of traditional hedge funds, family offices, exchanges, founders, and other high-net-worth crypto OGs. Blakey, a former poker professional and cofounder of Ascensive Assets, said in a statement, “Our mission at Paper Ventures is to be at the very forefront of innovation, fostering groundbreaking ideas that redefine the boundaries of technology and finance. We believe in the transformative power of blockchain and are committed to supporting those who are as passionate about its potential as we are.” Having navigated multiple market cycles since 2010, the founders have been early backers of now-dominant projects like Frax Finance, SEI, Polygon, Injective, Polkadot, Moonbeam, and Cosmos. Their portfolio also extends to gameFi projects such as Merit Circle/Beam, Illuvium and YGG. Chaudhry, with a background in traditional finance, said in a statement, “With Paper Ventures, I’m excited to invest in groundbreaking ideas and also to use my experience to elevate the brilliant minds behind them, fostering a collaborative ecosystem that propels innovation to unprecedented heights.”

April 8th, 2025

Cap Secures $11M Seed Funding From Franklin Templeton, Susquehanna for Stablecoin InnovationStablecoin company Cap has raised $11 million in a seed funding round led by Triton Capital, Franklin Templeton, and Susquehanna International Group. Participants included crypto-native firms like Superscript and Rockaway X, alongside market makers GSR, IMC Trading, Nomura’s Laser Digital, and Flow Traders. The funding follows a $1.1 million community round executed partially on Echodot, involving groups such as Omega, Patrons, and Crab Notes. Founders and teams from projects affiliated with the “Mega Mafia” ecosystem—including MegaETH Labs, Hop Network, and Euphoria Finance—also contributed. Cap aims to address challenges in stablecoin sustainability, particularly the lack of safe yield options. Over $240 billion in stablecoins circulate globally, but generating risk-managed returns remains a hurdle. The company claims existing models, including endogenous designs or hedge-fund-like strategies, require reinvention.

March 12th, 2025

Rakurai Raises $3M Seed Round to Accelerate Development of High Throughput Solana NodesRakurai, the infrastructure project supercharging Solana staking, has closed a $3 million seed funding round led by Anagram Ventures. Other investors in this round include Paper Ventures, Colosseum, Slow Ventures, Robot Ventures and Crypto.com. P2P.org, GlobalStake and Cyber Fund also participated, highlighting Rakurai’s potential to drive significant advancements in decentralized infrastructure. Today’s funding will advance the rollout of Rakurai’s high-yield Solana staking platform, offering high QoS (quality of service) transaction landing through increased efficiencies to retail and institutional participants alike. In standard benchmark tests, Rakurai nodes deliver 5x the TPS (transactions per second) compared to the standard Solana client. The investment will also fuel product development and partnership growth.

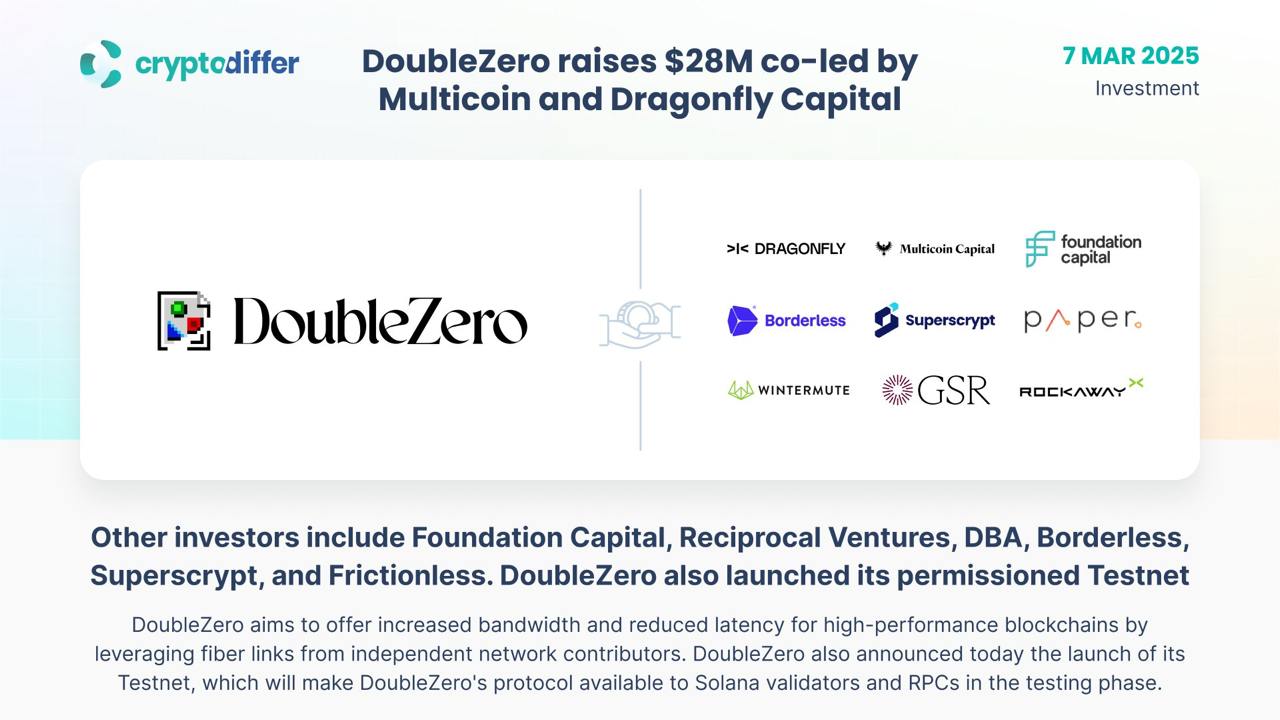

DoubleZero Foundation, a startup building a “new internet” to improve blockchain performance, raised $28 million at a $400 million valuation, according to three people familiar with the matter, and is now searching for “strategic partners” to invest more at $600 million. Dragonfly and Multicoin Capital lead the initial funding round, two of the people said. The subsequent strategic round hasn’t yet closed, said one insider. Venture capital firms have been jockeying hard for whatever allocation they could get, another said.

February 27th, 2025

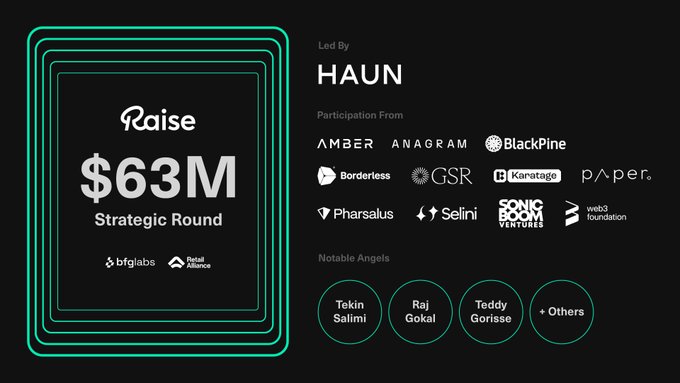

Raise Secures $63 Mn Funding to Transform the Payments and Loyalty Industry with Blockchain-Powered Gift CardsRaise, a leader in the global gift market and pioneer in blockchain-powered payments and loyalty, has secured $63 million funding round led by Haun Ventures, the round included participation from Amber Group, Anagram, Blackpine, Borderless Capital, GSR, Karatage, Paper Ventures, Pharsalus Capital, Selini Capital, Sonic Boom Ventures, the Web3 Foundation, and notable angels Tekin Salimi, Raj Gokal, Teddy Gorisse among others. This latest round brings Raise’s total funding to over $220 million, building on prior investments from Accel, Paypal, and New Enterprise Associates (NEA). “Raise has redefined how consumers interact with and value gift cards – it’s about loyalty and share of wallet, not just gift-giving,” said George Bousis, Founder and CEO of Raise.

January 9th, 2025

Verifiable AI firm Rena Labs raises $3.3 million in pre-seed fundingThe verifiable artificial intelligence firm Rena Labs raised $3.3 million in pre-seed funding, which makes up the firm's total funding to date. Paper Ventures led the round, with additional support from other investors, including Lightspeed Faction, Eterna Capital, Lyrik Ventures, Mapleblock Capital, Selini Capital and Keyrock, according to a release shared with The Block. Rena Labs plans to use the funds to expand its team with developers and industry experts and bolster its abstraction middleware, Trusted Execution Environment, or TEE, which aims to create on-chain infrastructure for verifiable AI use cases.

November 26th, 2024

Vanilla Finance Closes Pre Seed Investment Round led by UOB Ventures, Paper Ventures & ABCDE LabsVanilla Finance, the #1 exchange by trading volume on Telegram, today announced the successful closure of their Pre-Seed investment round led by Paper Ventures, UOB Ventures, & ABCDE Labs among other top tier ventures and investors, including HTX Ventures, Ocular, Openspace, Y2 Ventures, Signum Capital and angel investors from STEPN, Scroll, XAI, Cherry Ventures and more. This significant funding round coincides with Vanilla Finance’s notable achievements in the Digital Asset sector, where it has quickly risen to become the #1 exchange by trading volume on Telegram, amassing over $8 billion in USDT trading volume within the first 60 days of launching. Vanilla Finance has further solidified its position by winning the Binance MVB Season 8, an accolade that not only celebrates its innovative trading solutions but also recognizes its market leadership and success.

November 25th, 2024

Web3 Game Studio Qooverse Secures Investment in Round Led by Paper VenturesWeb3 game studio Qooverse has secured pre-seed funding in a round led by VC firm Paper Ventures, followed by Animoca Brands, Merit Circle, and notable angels in the industry. Founded by a creative team whose professional background includes time at Tencent and Goldman Sachs, Qooverse is developing an ecosystem of mid-core and casual social games that are distributed on Telegram and more social platforms to come. The portfolio of games revolves around the IP Qoomon, cute yet formidable creatures in an Oriental style. The games are fast-paced with an average game lasting less than 5 minutes. They are also highly social with an emphasis on PvP (Player vs Player). The flagship game Qoomon Fuse has successfully attracted a few hundred thousand players organically within a month. Qooverse also views the omni-channel distribution as a great opportunity. The team has been distributing the games as Telegram mini-app with the next avenues being Line mini-app and Discord embedded app.

November 11th, 2024

TAC raises $6.5 million to provide TON and Telegram users in-app access to EVM applicationsTON network extension TAC has raised $6.5 million in a seed funding round led by web3 venture capital firm Hack VC and Symbolic Capital to help provide TON and Telegram users in-app access to Ethereum Virtual Machine applications. Primitive, Paper Ventures, Karatage, Animoca Ventures, Spartan Capital, TON Ventures and Ankr also participated in the round alongside angel investors, such as Polygon co-founder Sandeep Naiwal. A valuation and the structure of the round were not disclosed. TAC’s founding team includes TON venture builder TOP (The Open Platform) and Curve creator Michael Egorov. The project aims to simplify building on TON, connecting Ethereum's developer community and applications directly with TON blockchain and tapping into its close affiliation with the Telegram messaging platform, which has an estimated 950 million global users. The funding will be used to scale the project's marketing, developer relations and tech development efforts to connect various EVM applications across DeFi, GameFi, SocialFi and RWAs while enabling wallet abstraction to simplify self-custody of TON and Ethereum assets, the team said in a statement shared with The Block. TAC’s infrastructure will be partially secured by TON liquid staking tokens, introducing restaking to the ecosystem.

October 16th, 2024

Dox Radio - EP 049 - Oliver & Danish | Paper VenturesOliver, a former professional poker player, and Danish, a seasoned financial expert with experience at prestigious firms like Ernst & Young and BlackRock, have joined forces as two of the three co-founders at Paper Ventures, an investment firm dedicated to navigating the ever-evolving world of emerging technologies. Their unique backgrounds, combining high-stakes risk-taking and deep financial expertise, have allowed them to create one of the most successful funds in the Web3 space. Paper Ventures has been able to leverage these complementary skills to identify promising opportunities and capitalize on the growth of decentralized technologies. In this interview, they share their journey from making early individual investments to closing multi-million-dollar deals, providing invaluable insights for those eager to succeed in the rapidly expanding Web3 market. Their experience highlights the importance of understanding both the technological advancements and the community-driven nature of Web3 projects.

October 11th, 2024

KIVA AI Secures $7M to Transform AI Development With Enhanced Human Feedback OperationsKIVA AI, a promising new platform dedicated to advancing AI technology through improved data curation and human feedback, has successfully raised $7 million in a funding round led by Brooklyn-based Web3 investor CoinFund. The round attracted participation from a lengthy and diverse range of funds and family offices including Paper Ventures, Protagonist, Foresight Ventures, Hashkey Capital, PEER VC, NGC Ventures, Big Brain Holdings, and Breed VC, as well as influential angel investors like wikiHow founder Jack Herrick, Slavin Rubin, Cyrus Massoumi, former Tinder CPO Brian Norgard, and former Al-Nassr FC chairman Mussali Al-Muammar. Specializing in data collection, foundational model training, and AI fine-tuning, KIVA AI is poised to deliver the next generation of human feedback operations, with the goal of enhancing AI quality and reducing costs at scale. The company’s strategy is focused on addressing the growing market need for reliable, scalable human feedback mechanisms as demand for quality AI training intensifies.

September 18th, 2024

Limitless Labs Secures $3M Funding from 1confirmation to Revolutionize Prediction MarketsLimitless Labs, the innovative R&D network specializing in prediction markets, blockchain, and AI, has secured $3 million in upfront funding led by renowned investor 1confirmation. The funding round also saw participation from major investors such as Paper Ventures, Collider, and Public Works. Founded in December 2023 by CJ Hetherington, Roman Mogylnyi, Dima Horshkov, and Rev Miller, Limitless Labs is the driving force behind the rapidly growing prediction marketplace, Limitless. The platform has experienced explosive growth, with an 800% increase in volume last week alone, now handling over $200,000 in daily transactions. Impressively, half of its active traders engage with the platform daily, highlighting high user engagement and rapid adoption.

August 16th, 2024

Holonym Foundation Emerges with $5.5 Million Seed Funding to Provide Global Digital Personhood with Human KeysLed by Finality Capital and Paper Ventures, with participation from Arrington Capital, Draper Dragon, Lightshift, and others. Holonym Foundation, an organization building the next generation of digital identity security for the decentralized web, is announcing the completion of a successful $5.5 million seed funding round. The funding round was led by Finality Capital and Paper Ventures, with significant participation from Draper Dragon, Arrington Capital, Lightshift, Zero Knowledge Ventures, Zero DAO, and other prominent funds. Cryptographic keys, or private keys, run the web and secure every digital interaction on the internet. But what if private keys could be built differently and in a more sophisticated way? Human Keys completely change how private keys are derived. Instead of creating private keys from random phrases, Human Keys make humans into keys. This new framing shifts ownership of digital assets from the holder of a random seed, to the human that can uniquely prove their biometrics. Human Keys make the ownership layers of the internet built on top more consumer-friendly, decentralized, and secure.

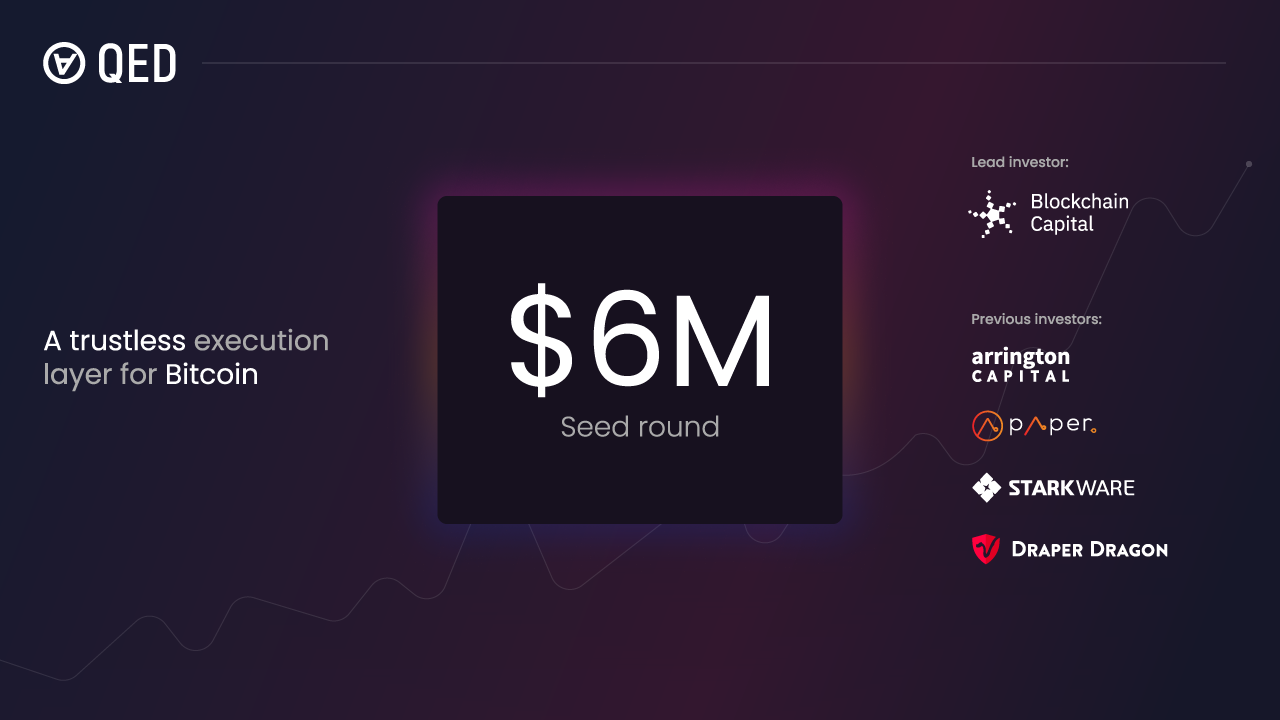

QED Protocol, the first zk-native execution layer for powering the Web3 ecosystem emerging on Bitcoin, announced today that it has raised $6 million in a funding round led by Blockchain Capital. The fresh influx of capital furthers QED’s mission of utilizing its novel technology to unlock unparalleled performance for smart contracts, layer-two solutions and a wide variety of Web3 applications. Among QED’s breakthroughs is a novel solution for verification of zero-knowledge proofs, or ZKPs, on Bitcoin that radically increases scalability while preserving maximum security. This is a first-of-its-kind innovation in the ZK world that can unlock significant performance enhancements, enabling native smart contracts that had previously been lacking on Bitcoin and holding out the potential for applications to be powered with minimal latency and with speeds already capable of surpassing 150,000 transactions per second. In a statement, QED founder Carter Feldman lauded the recent funding and emphasized how QED’s technology is compatible with Bitcoin Core by harnessing the power of Taproot script and ZKPs. “This funding round is key to pursuing our mission to bring Bitcoin security to all of digital finance, but in a way that unlocks unmatched performance and utility,” said Feldman. “Indeed, our aim is to extend the full security of Bitcoin to all of Web3 and eventually the rest of the internet, and, in doing so, our value proposition is simple: high throughput, low latency and application-friendly performance that benefits the masses.”

Glacis, a groundbreaking Firewall and Router Protocol for simplifying cross-chain operations, recently secured $2 million in seed funding from leading investors Arrington Capital and Paper Ventures. This funding underscores Glacis’ commitment to enhancing the security and efficiency of multi-bridge, chain-agnostic services in the web3 space. With the proliferation of new blockchains, managing apps across different chains has become increasingly complex. Glacis, developed in collaboration with Moonsong Labs, aims to streamline this process, allowing developers to focus on innovation rather than infrastructure challenges. Jacob Blish, a Glacis Founding Contributor, highlighted the inspiration behind Glacis, stemming from his experience dealing with bridge hacks and the limitations of existing cross-chain technologies during his tenure at Lido. Glacis seeks to address these challenges by providing an intuitive tool that not only simplifies the developer experience but also enhances security by minimising single points of trust. Glacis stands out for its ability to simplify the utilisation of multiple blockchain bridges, a traditionally intricate and risky endeavour. It offers user-friendly, open-source capabilities for building secure, multi-bridge apps, ensuring reliability and robust protection against persistent cross-chain threats.

April 16th, 2024

Aligned Layer Secures $2.6M in Funding to Become a Faster and Cheaper Settlement Layer for Validity Proofs on Top of EigenLayerAligned Layer has successfully raised $2.6 million in a funding round led by Lemniscap, a VC firm specializing in emerging crypto assets and early-stage blockchain startups. The round also won investment from Paper Ventures, Bankless Ventures and industry angels. The raise marks a significant milestone in Aligned Layer’s mission to accelerate Ethereum’s roadmap by making Ethereum a better settlement layer for validity and ZK proofs. Aligned Layer is at the forefront of developing a verification layer on top of Eigen Layer, the decentralized protocol that lets users restake ETH for potentially higher rewards. The project aims to transform Ethereum into a better, faster and cheaper settlement layer by offering a cost-effective validity proof and ZK proof verification platform, leveraging the security of Ethereum validators without the EVM limitations. “We are thrilled to have the support of Lemniscap, Bankless Ventures and Paper Ventures as we work to make Ethereum the best settlement layer for proof verification,” said RJ, one of the Founders of Aligned Layer. “Our technology is not just an incremental improvement, it’s a major leap forward in making Zero Knowledge proofs and Validity proofs more accessible and practical for the entire blockchain ecosystem." Aligned Layer’s approach is unique in its ability to enable cost-effective and fast verification of any ZK proof. This will allow developers to build new trustless and scalable applications such as Bridges, Rollups, ZKML and on-chain gaming. It aims to become a pivotal player in supporting ZK technology development and research. The team, comprising experienced cryptographers and distributed services experts, is backed by several influential advisors from relevant industry projects.

Modular L2 building the future for onchain consumers Camp Network raised $4M Seed funding round led by Maven 11, with participation from OKX Ventures (ex OKEx Blockdream Ventures), Protagonist, Inception Capital (ex OP Crypto), Paper Ventures, Merit Circle, Hypersphere, Eterna Capital, IVC, HTX Ventures (ex Huobi Ventures) and others, and select angel investors including Eigen Layer, Sei Network, Celestia, Selini Capital, Ethena, and top-level music executives. The new capital will be used to support the network as it approaches mainnet launch and accelerate the growth of over 25 teams already building in the Camp Network ecosystem. James Chi, Cofounder of Camp Network, said “Blockchain infrastructure has developed tremendously over the past few years, and the future of blockchain will be defined by how that technology is delivered to and used by consumers worldwide. This investment will propel Camp Network’s mission to redefine the future of onchain consumers and further develop our ecosystem for any consumer use case.” User engagement data is one of the most valuable data sets, yet applications today struggle to track it. Through its “digital backpack”, Camp Network leverages offchain engagement data from social and streaming apps – where most of users’ digital identities exist today – to help consumer applications better understand and incentivize valuable behavior. The team has made incredible progress in the last three months since its initial launch. There are 20+ teams already building in Camp Network’s ecosystem, with a combination of native teams as well as teams migrating over from larger ecosystems. Balder Bomans, Managing Partner of Maven 11, commented “We believe that for blockchain technology to achieve true mainstream adoption, a greater focus should be placed on onboarding the next wave of consumers. In our conversations with the Camp Network team, we were immediately struck by their strong backgrounds and their clear vision for the applications needed in the consumer domain to track user engagement. Over the past few months, their capability to attract leading teams in the space has proven that they are developing something that projects have long awaited.” With the completion of its successful seed round, Camp is looking to double down on its ecosystem efforts to redefine consumer crypto. The Company is launching its public testnet in April ahead of a mainnet launch in June.

March 30th, 2024

Blockhain Sophon Secures $10M in Funding from Renowned Investors While Shrouded in MysteryMysterious blockchain Sophon has successfully raised $10 million led by Paper Ventures and Maven11. The funding round attracted contributions from prominent firms such as Spartan, SevenX, OKX Ventures and Huobi Ventures. With nothing more than a handful of tweets thus far, the details of exactly what Sophon entails remain largely unknown. The project’s enigmatic X bio merely states that it is a “modular blockchain powered by [BLANK] and [BLANK] on [BLANK], leading us all to a brighter future.” “Our investment in Sophon aligns with our vision to support projects which are not just technologically advanced but also have the potential to make a profound impact on their communities,” said Danish Chaudhry, General Partner of Paper Ventures. “Sophon’s unique and innovative approach to blockchain building presents a new frontier in the industry. We are thrilled to be part of this journey and entirely confident in Sophon’s ability to make a huge impact on not just web3 but beyond.” Leading figures from multiple industries have been liaising with Sophon for additional strategic collaborations, with details to be revealed by the team in due course and several projects rumored to be building on Sophon in the gaming and AI space. With its robust network, strategic collaborations and fierce commitment to innovation, Sophon has already made a considerable impact on the VCs and angel investors that have decided to support its secretive vision. The pioneers behind the project are excited to share more details very soon.

February 27th, 2024

QED Secures $3 Million In Funding To Propel Fully Trustless Zero-Knowledge Applications Across The Bitcoin EcosystemQED, the world's first zk-Native blockchain protocol, announced today it has raised $3 million in a funding round led by Arrington Capital with participation from several prominent venture capital firms and companies including Starkware, Draper Dragon, Blockchain Builders Fund, Lbk Labs, Paper Ventures, Valhalla Capital, Edessa Capital and Anagram Ltd. QED aims to revolutionize Bitcoin by combining the scalability of Zero-Knowledge (ZK) Proofs with the liquidity and security of Bitcoin (BTC). QED’s cutting-edge technology, developed by the pioneering team that implemented modular arithmetic in TapScript, is a unique approach to empowering more applications for BTC. Decentralized applications built on QED can locally prove transactions, providing users with unlimited computation for a fixed gas fee. This innovative method ensures that every user's public key functions as a custom ZK circuit, featuring 'smart signatures' that can be read from state, resembling a smart contract. “Bitcoin has traditionally lagged behind other blockchain protocols due to its lack of support for smart contracts and decentralized applications. But we believe it has the power to be far more than just gold – it can be the foundation of the entire decentralized economy,” said Carter Jack Feldman, Founder of QED. “QED will be the execution layer of Bitcoin, combining the power of ZK proofs to enable functionality like smart contracts and DeFi with the full security of a Bitcoin. We’re pioneering a new frontier for decentralized applications that can take advantage of the liquidity of $1.01 trillion and growing Bitcoin market cap.” QED is designed to address many of the current shortcomings in Web3, including the challenges of building on blockchain, scalability issues, and poor user experience. As the world’s first horizontally scalable blockchain, it benefits from increased throughput due to a greater number of network nodes and allows any Web2 developer to write a QED smart contract using popular programming languages Javascript and Python. With the QED’s Dapen Web IDE (integrated development environment), developers can build in mere seconds before deploying their smart contracts to the QED protocol. A key feature of this protocol is its end-to-end Zero-Knowledge Proof (ZKP) recursive verification, ranging from local transaction proof to final block proof. This makes QED highly secure and versatile, the perfect execution layer for all blockchains and zero-knowledge virtual machines (zkVMs). “We thrive on supporting exceptional teams and QED stands out as one that will accomplish much for the Web3 ecosystem. We believe QED is poised to reinvent what is possible with Bitcoin as it empowers developers, a crucial group in the ongoing expansion of the Bitcoin ecosystem,” said Michael Arrington of Arrington Capital. “With a distinctive approach to securely scaling horizontally with a TPS that increases with usage, QED will ignite a new wave of smart contract usage and applications that we believe people who are native and new to web3 are more than ready for.” QED supports all Layer-1 chains and WebAuthn Wallets, while accommodating current zkVMs and boasting the capability to facilitate millions of User Operations per second (UOPS). Its robust security model ensures high censorship resistance and immunity to front-running. QED has an ambitious roadmap for 2024. This includes the Testnet for the decentralized proving network early in the year, followed swiftly by the QED mainnet and a token event.

February 22nd, 2024

Monkey Tilt Raises $21 Million in Funding Round Led by Polychain CapitalAccording to BlockBeats, GambleFi platform Monkey Tilt has announced the completion of a $21 million financing round. The funding round was led by Polychain Capital and included participation from Hack VC, Poker Go, Accomplice, Paper Ventures, and Folius Ventures. This significant investment will likely be used to further develop and expand the Monkey Tilt platform, which is part of the growing GambleFi ecosystem. The platform aims to provide users with a decentralized and secure gaming experience, leveraging blockchain technology to ensure fairness and transparency. The involvement of prominent investors such as Polychain Capital, Hack VC, and others highlights the growing interest in the GambleFi sector and the potential for platforms like Monkey Tilt to disrupt traditional gaming and gambling industries. As the industry continues to evolve, it will be interesting to see how Monkey Tilt and other GambleFi platforms capitalize on this momentum and shape the future of gaming.

January 30th, 2024

Web3 Social Game Forgotten Playland Completes $7M in Seed RoundWith several products in the pipeline, the Forgotten Playland team is confident the ecosystem will grow exponentially in the coming years. Web3 social game Forgotten Playland announced the completion of a $7 million seed round of financing, with participation from Merit Circle, Spartan Group, C2 Ventures, Paper Ventures, and others. Forgotten Playland is scheduled to be released in the first quarter of 2024 and will include a series of mini-games, with Bump-A-Ball and Jungle Rumble already confirmed, with more in development. Forgotten Playland is understood to have more than 25 employees. “Forgotten Playland is a project close to our hearts. Co-developing our own game is a dream come true, and we’re thrilled to make it the flagship game of the Merit Circle DAO. Our vision extends beyond the game, as we believe there are numerous opportunities with the IP of Forgotten Playland. We invite you to explore the attic, the homeland of our forgotten toys, and enjoy the upcoming minigames,” says Marco van den Heuvel, CGO at Merit Circle. Similar remarks were made by Danish Chaudhry from Paper Ventures, who added that the Forgotten Playland has a promising future to redefine player engagement. Moreover, the Forgotten Playland core developers have years of experience in building reputable games with a high volume of online presence, thus promising more products are in the pipeline, especially after securing crucial funding.

January 16th, 2024

Renzo Raises $3.2M to Mainstream Liquid Restaking on EigenLayerDeFi protocol Renzo has announced a $3.2M seed round with the support of leading crypto native funds. The funding will be used to help Renzo build out its liquid restaking protocol which recently went live on EigenLayer. Maven11 led the Renzo seed round which also saw follow-on investments from Figment Capital, SevenX, IOSG and Paper Ventures among others. The raise arrives at a time when interest in liquid restaking on EigenLayer is at an all-time high. More than 2,000 users have deposited $20M of ETH (9K ETH) into Renzo since its protocol was deployed in late December. Commenting on the funding round, Renzo Founding Contributor Lucas Kozinski said: “It’s a pleasure to welcome so many distinguished investors who share our vision of making restaking accessible to everyone. With their support we will make Renzo the most reliable on/off ramp for Ethereum restaking, building upon the new capabilities offered by EigenLayer.” Balder Bomans, Founder and Managing Partner at Maven11, added: “Renzo’s focus on security, risk mitigation and open finance is, in our view, the best way to tackle a liquid and decentralized governance procedure for picking Actively Validated Services (AVS) on Eigenlayer. Renzo delivers risk-adjusted strategies and liquid representations while providing security to restakers.” Renzo uses a combination of smart contracts and operator nodes to supply automated liquid restaking strategies on EigenLayer. This makes it easier to manage liquidity and capitalize on the ability to participate in Ethereum staking while exploring additional restaking opportunities. Renzo enables ETH and Liquid Staking Tokens (LSTs) to be restaked and utilized as DeFi collateral to earn compounding rewards. To support decentralization, Renzo will be governed by a DAO that manages operators, AVS restaking strategies, and protocol parameters. Future releases will introduce support for cross-chain restaking, integration with lending markets, liquidity aggregators and vault products with a focus on institutional on/off ramps.